Strategy April 15, 2018

Promotional Products State and Regional Sales Report - 2018

A shrinking revenue divide means good news all over the map.

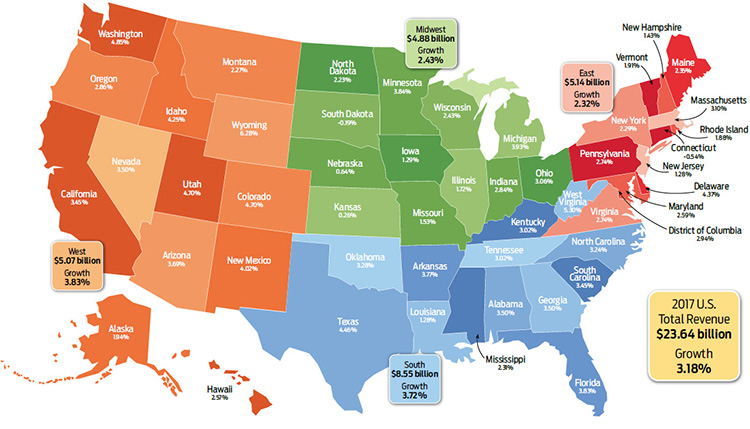

One year ago, our exclusive report showed that multiple percentage points separated the West and the South from the East and Midwest for promotional products revenue growth. The narrative was clear: The tradition-bound economies of the East and Midwest were recasting their identities while the West and South were moving forward on the backs of population shifts and dynamic economic growth.

Now, one year later, the divide isn’t so clear-cut: Just a percentage point and a half divide the four regions. What happened? Start with Mother Nature. Hurricanes battered Texas and Florida in 2017, causing billions in damage (the costliest natural disasters in U.S. history). Texas and Florida are two of the three largest U.S. promotional products markets. “While both of these states experienced growth this year, they were also heavily affected by natural disasters,” says Nate Kucsma, ASI’s executive director of research and corporate marketing. “If not for these events, the growth the South region experienced likely would have been stronger.”

Report Stats

In the Midwest, Ohio, Illinois and Michigan comprise the region’s three largest markets. Last year, the first two demonstrated negative growth while Michigan only registered a 0.4% uptick. This year, all three rebounded with increases of three and four percentage points, and stoked the Midwest to growth in line with the rest of the country.

A similar occurrence played out in the East, where New York and Pennsylvania overcame negative growth last year. Kucsma says these two states plus Virginia make up over 60% of the region’s sales, and their reasonably strong economic conditions propelled the region ahead. He adds the struggles of those states last year can be partly attributed to apprehension regarding the election. Without that uncertainty, business has found a confident path forward.

Podcast - Behind the Numbers

That leaves the West, which is this close to bounding over the East to become the second-largest regional market. (OK, $71 million actually separates the two – but that’s only about 1%). Concerted population migration along with fast-growing economies has created a bright future for the region. “Five of the six states that had the largest percentage changes in year-over-year population growth were all in the Western region – Idaho, Nevada, Utah, Washington and Arizona,” Kucsma says. “This coupled with a strong economic environment should position the West for robust economic growth in the coming years.”

Is growth in your future? The answer can be yes, no matter where you are.

Click here for a larger image of the map above

Click here for a larger image of the map above

West: Tech companies are in high gear and show no signs of slowing down. The U.S. information sector reported gains of 6.5% over the past three years, outpacing every other industry. Read more here!

South: Almost 600,000 Americans moved from the Midwest and Northeast to Sun Belt states in 2016, the most in over a decade, according to the Brookings Institution. Read more here!

Midwest: The U.S. is in its third longest period of economic expansion, and the consistency of growth has distributors in the Midwest enthused. Read more here!

East: Optimism is on the minds of distributors based in this region. And with good reason: The East’s 2.3% growth in promotional products revenue for 2017 is an improvement over the 1% it saw in 2016. Read more here!