Strategy February 07, 2018

Promo Market to Target: Automotive

Buying a car is a big decision – but road-tested promo products make it just a little easier.

Like car buyers, promotional products distributors taking the auto sector for a test drive usually arrive at the same place: the dealership. And with nearly 17,000 new car dealerships in the United States (plus an additional 20,000 “independent” used car dealers), there are a lot of places to choose from.

There’s a simple but huge reason that car dealerships use promotional products: to drive traffic with the goal of landing a customer. Ideally, that person will remain loyal not just for the life of one car, but for the entirety of that person’s time behind the wheel.

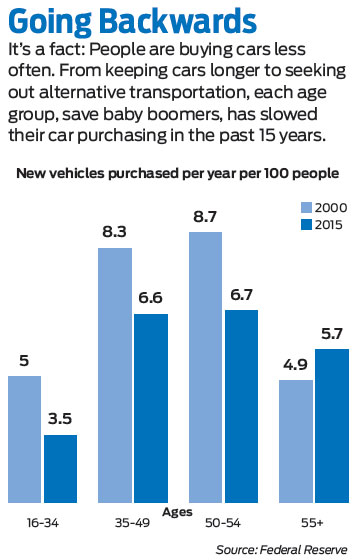

Naturally, dealerships will pay to get customers into their showroom, and the urge to find them may intensify given the current state of the automotive market. Nathan Shipley, automotive industry analyst for NPD Group, says that last year’s car and truck sales were somewhat soft, with forecasts ranging from 16.8 million to 17.3 million vehicles sold – a decline compared to 17.6 million in 2016.

Why? Because despite the boost of spending due to low gas prices, American drivers are simply keeping their cars longer and ignoring the impulse to upgrade to a newer model. (See sidebar below.)

In the face of slowing sales, panicky dealerships may look to cut marketing and promo spending, but Dan Jellinek, executive vice president of sales for Top 40 supplier The Magnet Group (asi/68507), advises distributors to stand firm. He cites studies showing the businesses that continue spending in a downturn will ultimately benefit. “Maybe the budget will be smaller, but it’s a mistake for people to shut down and stop spending,” he says. “You’ve got to keep the name out there.”

Popular Models

Tricia Murray, strategic account manager for Top 40 distributor Staples Promotional Products (asi/120601), says the automotive market pays special attention to quality because dealers are proud of the vehicles’ quality and want that to be mirrored in their choice of promotional products. They are most interested in “practical and cool retail-branded stuff people will use in their car every day,” she says. She mentions drinkware like Klean Kanteen and Yeti in addition to Pelican coolers, bamboo sunglasses, foldable blankets and Bluetooth key finders – “things that are durable,” she adds.

Apparel is also used to outfit dealership sales staff or to stock corporate company stores, with popular brand names such as Calloway, Under Armour, Nike and North Face. It’s a contrast for Murray from her previous work in the banking industry, where she says clients aren’t as eager to align with brands with a good reputation.

Not every product has to be a high-end retail item – but it certainly has to be functional or provide an enticing proposition for potential car buyers. Grant Mayan, promotional products expert at The Promo Addict (asi/302225) who previously ran several automotive aftermarket stores, creates corporate branding on hoodies, hats and air fresheners, and uses drinkware and tech items as high-end appreciation gifts. But the distributor’s biggest success in growing its dealership business is using items like pens as a vehicle for referrals and retention. Specifically, Mayan cites pens from Riteline (asi/82498) that clip into the dash of a car and can function as a coupon when given to a first-time guest or friend. “Nobody is going to get extremely excited about a pen,” says Mayan, who has executed a similar concept with car coasters from CoasterStone (asi/60965), “but it’s about the messaging and the execution. It’s about finding a way to get them to test-drive your offerings for a very low cost.”

Sue Scheibenpflug, promotional sales manager at Ready4 Kits (asi/80882), says the company’s fully customizable car kits – refillable bags containing items like a flashlight, first-aid packet, rain poncho, auto hammer and booklets on changing a tire or car safety – are very popular with the automotive market. Both the high-quality bag and the flashlight are imprinted with a company logo, she says, and Ready4 Kits is working toward being able to imprint the poncho itself this year. “Branded items are fantastic,” Scheibenpflug says, “and people will remember that you, in their time of need, cared enough to give them this kit.”

Jellinek cites car magnets as an essential way to promote a brand or dealership. “It’s great for other industries, but they’re going on a car,” which makes them perfectly suited to the auto industry, he says. Magnet offers relevant products, including tire gauges, stress-ball tires, tool kits, high-end flashlights with hazard lights, and vinyl products to hold insurance cards and registration papers in the glove box.

In addition, luxurious blankets and trunk organizers have been good for The Magnet Group, as have picnic blankets. These items don’t always have to go inside new cars, Jellinek says, but for high-end dealers, they can function well as a memorable giveaway to someone who test drives, say, a Mercedes. He recommends this approach: “Ask the dealership, ‘Will you spend $5 or $10 to get someone into a car?’” Most dealers selling cars at this price point consider this a no-brainer, he says: “Luxurious cars need luxurious products. If someone’s going to buy a $60,000 automobile, what are we going to do to make them feel great about the purchase?”

Who’s Driving the Decision?

While dealerships and car buyers are a massive area to target, they’re just part of the sprawling auto ecosystem. Also included are mechanics, detailers and aftermarket stores; tire and oil companies; car shows; third-party logistic providers; and a whole host of industrial outfits, including OEMs (Original Equipment Manufacturers), rubber fabricators, parts suppliers and more.

Staples’ Murray recommends considering many fronts, then zeroing in on just one. From the dealerships, the headquarters, and the ancillary parts and service businesses, “There’s a lot of opportunity in this industry,” says Murray, who most often deals with parts managers at the dealer level, in addition to OEMs and corporate buyers. “The goals of a dealership are going to be different than the goals at a corporate level.”

And dealerships themselves aren’t a single amorphous entity. From sales to service to customer support, there are a myriad of ways for dealers to promote best practices, improve morale and reward employees. In fact, selling new cars isn’t as important as you might think: NPD’s Shipley says dealerships today are largely making their money selling used cars and servicing cars.

While salespeople are conditioned to sell promo items, Mayan says it’s essential to educate service departments and techs in how to actually hand out these products, “instead of having them sit in a pile in the corner. You need the buy-in from the team in order to do it.” His biggest challenge is finding a way to have that conversation and get that initial sale. “It’s difficult to track an ROI on apparel, but if you can prove it with another product first, you’ll get the other business,” he says.

Jellinek says anyone walking into a dealership hoping to sell promotional products should also pay attention to how that dealer awards its salespeople. Think about recognitions such as top salesperson at the dealership, best safety record for mechanics, or even top overall dealership as bestowed by a manufacturer, he advises. “There are always different pieces of crystal on people’s desks,” Jellinek says. “How are you recognizing that top salesperson? We encourage our distributors to say these things in their meetings.”

For dealerships, Murray says parts managers are the biggest buyers. It makes sense, considering car dealers aggressively sell maintenance packages with the purchase of a car to keep customers coming back. However, that’s affected the success of aftermarket stores. “It’s not what it used to be three or four years ago,” Mayan says, “and even more so on the commercial side, which hasn’t bounced back like the retail side has.”

On the corporate level, “fix operations” (parts and service), buying operations and human resources are all relevant buyers. Murray’s approach involves spending a lot of time researching the organization itself: its pain points, initiatives and objectives for the year. “I also look at any new launches and see what products would tie in with that,” she adds. “I go to them proactively with products that have a strong business fit.”

Pumping the Brakes

In these days of Uber ease and ride-sharing, are Americans throttling back on their desire to drive? Recent data is mixed.

They’re certainly driving more. According to the Federal Highway Administration, American drivers logged 3.2 trillion miles in 2016, a year-over-year increase of 1.5%. The previous year, miles driven increased by 3.5%, though previous to that, totals stayed mostly flat since 2004. There are a number of reasons for the recent increase: Fuel prices have remained low the past couple years, the economy has been stable and older drivers are staying on the road longer.

However, they aren’t necessarily buying more. Car sales were forecasted to slow in 2017, thanks to factors such as rising interest rates and tightening credit markets, in addition to recalls reaching an all-time high.

Also, a generational schism regarding driving habits is beginning to emerge. Ten percent fewer Americans under 35 have driver licenses compared to the 1980s. Millennials are looking at ride-on-demand services and calculating whether that will be cheaper than driving their own car and paying for parking at events such as concerts, says Tricia Murray of Staples Promotional Products (asi/120601). “Where someone in the past may have filled up their car and driven everybody to a concert, it’s no longer the only way,” she says.

Even though miles driven increased in 2016, “the growth rate has really slowed down,” says Nathan Shipley of NPD Group, and a lot of this can be wrapped up in what he calls “the homing trend.”

Just look at online shopping, Netflix and Door Dash food delivery, he says. “People staying home means cars requiring less maintenance,” he says, “which means dealerships taking share away from the market as they continue to sell more new cars.” Shipley says his research has shown that even healthcare costs are chipping away at discretionary spending power. Add to that the fact that baby boomers are retiring in droves, Shipley points out, and you get a soft overall market. “If you’re not driving to work five days a week,” he says, “you’re just not driving as much anymore.”

Sarah Protzman Howlett is a contributing writer for Advantages.