News April 16, 2025

Koozie Group & Garyline To Combine Under Same Private Equity Ownership

Mill Point Capital LLC, a New York City-based PE firm, has acquired Koozie Group. The firm already had Garyline in its portfolio.

Key Takeaways

• Major Promo M&A Deal: Private equity firm Mill Point Capital has acquired Koozie Group (asi/40480) and plans to combine it with Garyline (asi/55990). Both suppliers are Counselor Top 40 companies.

• Size: Combined, Koozie Group and Garyline reported 2024 North American promo revenue of $360.9 million.

• PE Power: The acquisition and subsequent wedding of the suppliers marks another M&A deal in which private equity investors have brought together Top 40 companies.

Two more Counselor Top 40 firms are joining forces in what’s another major promo M&A deal fueled by private equity investment.

Mill Point Capital LLC, a New York City-based private equity firm, has acquired Counselor Top 40 supplier Koozie Group (asi/40480) and plans to combine the Florida-headquartered company with Garyline (asi/55990) – another Sunshine State-based Counselor Top 40 supplier that Mill Point already owns.

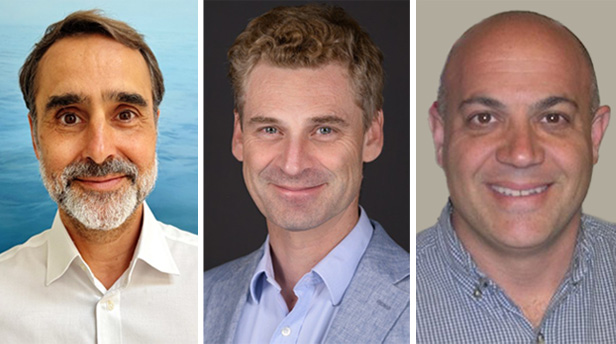

Antony Besso, Mill Point Capital LLC; Pierre Montaubin, Koozie Group (asi/40480); and Richard Hellinger, Garyline (asi/55990)

“With this acquisition, we are creating one of the largest players in the promotional products space,” said Antony Besso, a Mill Point partner and executive chairman of Garyline. “As the industry continues to evolve, we believe that scale and product breadth will be essential for serving customers efficiently and effectively.”

While Koozie Group and Garyline are now owned by the same legal entity, they will continue to go to market under their respective names for the time being, executives told ASI Media. Koozie Group generated a reported $301 million in 2024 North American promo revenue, while Garyline brought in a reported $59.9 million, meaning that had the firms been together that year they would have been a $360.9 million supplier.

“We are excited about the growth opportunities created by Mill Point Capital’s ownership,” said Koozie Group CEO Pierre Montaubin, a member of Counselor’s Power 50 list of promo’s most influential people. “This new financial support allows us to enhance our customer-centric focus through investments in our people, innovation and technology.”

$360.9 Million

Combined 2024 North American promo revenue of Koozie Group and Garyline

Coming Together

In addition to going to market under their respective names, Koozie Group and Garyline will keep current leadership structures for the time being. The firms also said they will be “maintaining normal operations as we enter this next chapter.”

Mill Point emphasized that both firms have a domestic manufacturing footprint that enables them to offer products manufactured, assembled or printed in the United States – an advantage, executives said, during this time of tariff-fueled trade war in which distributor and end-buyer interest in Made-in-the-USA promo products is on the rise. For example, about 30% of Koozie Group’s product portfolio falls within its “USA Proud” designation, which includes products that are made in the USA, assembled in the USA or printed in the USA (see here for distinctions).

“Our vision has always centered on customer performance, operational excellence and long-term investment in U.S. manufacturing,” said Richard Hellinger, CEO of Garyline. “We are proud to build on that foundation and support our distributors with enhanced scale, expanded resources and unmatched product diversity.”

“With this acquisition, we are creating one of the largest players in the promotional products space.” Antony Besso, Mill Point Capital LLC

In business since 1963, Garyline describes itself as a vertically integrated manufacturer, custom printer, and supplier of promotional products and specialty packaging. In August 2024, the company announced that it had completed a move from New York to a new state-of-the-art 440,000-square-foot facility in the Greater Tampa area in Florida.

The facility is located roughly 45 miles from Koozie Group’s headquarters in Clearwater, FL. Mill Point also announced its investment in Garyline in August 2024.

Garyline, a Counselor Top 40 #promoproducts supplier, has received an investment from an NYC-based private equity firm and completed a relocation to Florida. https://t.co/g3byNEh2FS

— Chris Ruvo (@ChrisR_ASI) August 28, 2024

“The new location allows [Garyline] to expand their product offerings and the depth of their customization capabilities, and the partnership with Mill Point reinforces Garyline’s focus on becoming one of the most innovative and successful promotional products companies in the industry,” Kim Korth, a Mill Point executive partner, said at the time

H.I.G. Capital, a private equity firm, previously owned Koozie Group, having purchased the company in 2017. Koozie Group, which rebranded to that name from BIC Graphic North America in 2021, is promo’s seventh-largest supplier based on 2023 North American promo revenue of $317 million. Garyline is promo’s 30th-largest supplier based on 2023 North American promo revenue of $62.6 million. Both firms saw year-over-year revenue declines in 2024. Counselor’s latest Top 40 supplier rankings, based on 2024 performance, are due out in July 2025.

Mill Point invests in lower-middle market companies across the business services, industrial and information technology sectors throughout North America. The firm’s portfolio includes companies with diverse focuses, from Voltaris, a provider of electrical power solutions, to Prime Pensions, which offers retirement plan administration services. Mill Point also owns Huntington Solutions, which makes foam packaging.

PE Drives High-Profile M&A in Promo

Mill Point’s acquisition of Koozie Group and combination of the firm with Garyline marks another recent M&A deal in which two Counselor Top 40 companies have fused – with private equity providing the financial fuel for the wedding.

In October 2024, Counselor Top 40 supplier S&S Activewear (asi/84358) completed the acquisition of Counselor Top 40 supplier alphabroder (asi/34063).

S&S and alphabroder were multibillion-dollar firms at the time – and ranked second and third, respectively, on Counselor’s 2024 list of the largest suppliers in the industry. Both S&S and alphabroder were private equity-backed at the time of the deal. PE firm Clayton, Dubilier & Rice is the majority owner of S&S and played a key role in supporting the acquisition.

In another blockbuster deal, Counselor Top 40 distributor iPROMOTEu (asi/232119) acquired fellow Counselor Top 40 distributor AIA Corporation (asi/109480) in the third quarter of 2024. PE firm Champlain Capital is invested in iPROMOTEu, which this year unified AIA under its brand.

In February 2024, Counselor Top 40 distributor Boundless (asi/143717) got the recent run of Top 40 M&A going by buying then fellow Top 40 firm Touchstone (asi/345631). Boundless came under private equity ownership in 2021.

Meanwhile, other PE-backed promo companies have been active making acquisitions, though not necessarily of other Counselor Top 40 businesses. Just one example? Late last summer, Counselor Top 40 distributor Overture Promotions (asi/288473) acquired Brandon, a promotional products distributor headquartered in Gothenburg, Sweden, that also has an office in Shanghai. Overture’s parent company is WestBridge Capital, a Canadian private equity firm that backed the Brandon acquisition.

Private equity and the promotional products industry has been a hotly debated topic, as PE investment in the merch space has grown considerably over the last decade.