News April 25, 2025

Q&A: The Basic Mechanics of Import Tariffs & Customs Clearance

A logistics broker offers direction on how to properly bring foreign-made products through U.S. customs as questions proliferate given new import duties.

Key Takeaways

• Compliance Deadlines: Tariffs must be paid to Customs and Border Protection within 10 days after goods are released for entry into the U.S.

• Payment Methods: Importers pay tariffs via brokers or Automated Clearinghouse accounts, with one payment per port of entry.

• Which Tariffs Apply: It’s based on product/good and then country of origin under the Harmonized Tariff Schedule.

The broad range of new tariffs that President Donald Trump has implemented in 2025 has thrown the importing and clearing of products through customs into the spotlight. Discussion on the mechanics of how tariffs are applied to imports – and what importers, who pay the levies, must do to be in compliance – have abounded in promo and beyond.

With that in mind, ASI Media spoke with importing expert Gretchen Blough, customs brokerage manager with Logistics Plus Inc. Here, she delivers some straightforward answers that will help those with questions understand the basic mechanics of import tariffs’ role in the customs clearance process.

Q: When are the tariffs due?

Gretchen Blough: They are technically due to Customs and Border Protection (CBP) 10 days after the entry is released. A release is an approval from customs for the goods to enter the United States.

Q: Who are the tariffs paid to?

GB: If the importer is working with a broker, the payment goes to the broker, who pays on the importer’s behalf. If the importer is not working with a broker, they can set up an Automated Clearinghouse account to pay CBP directly. Importers have one payment per port of entry. So, if an importer brings products in through Los Angeles and New York, there is one payment to LA and another to NY debited from the importer’s account.

Q: How does an importer know which tariffs to apply?

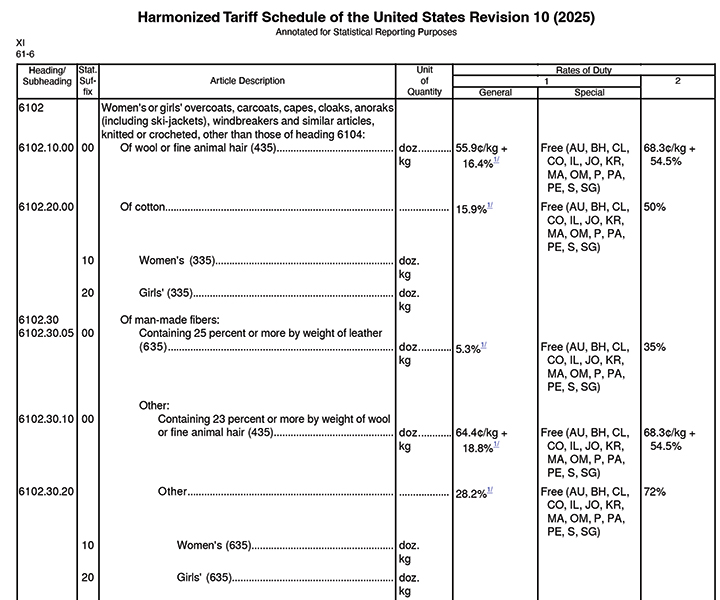

GB: It’s based on product/good and then country of origin under the Harmonized Tariff Schedule (HTS). A good broker will help you. They will ask a bunch of questions that might not make a lot of sense to you, but that helps the broker to classify your goods under HTS codes. Each one of these codes has a basic duty rate associated with it. It’s called “harmonized” since it’s harmonized across all countries up until the sixth digit. Some countries only use six digits. The U.S. goes to 10 digits.

If you’re interested in digging deeper on your own, review the Harmonized Tariff Schedule and look at the individual chapters, where you’ll notice that there are rates of duty columns. “Column 1-General” is what the duty rate is for most countries of origin. “Column 1-Special” is the rate for when the U.S. has a free trade agreement with a country. Chapters in HTS that may be of interest to the promotional products industry include 61, 62 and 63 for apparel and 73 for stainless-steel drinkware. Writing instruments are in Chapter 96.

An example of what the Harmonized Tariff Schedule looks like. This is from a chapter on apparel.

Q: If an imported product contains parts from multiple countries, how do the tariffs apply?

GB: Mostly, the country of origin is derived from where the most content or transformation, which usually corresponds with value, is added. In the case of some steel/aluminum derivatives, we would actually need to have the steel or aluminum content, and then the steel/aluminum tariffs apply to that content. We also need to know the country of smelt and the country of pour with steel/aluminum products.

“Logistics brokers can help determine HTS codes, duty rates that would apply, advise on paperwork and documentation needed, and interface with customs officers. We streamline and simplify the process.” Gretchen Blough, Logistics Plus Inc.

Q: Say a U.S. importer’s foreign-made products get on the water when the tariff rate on a country is 10%. But by the time they reach the U.S., the tariff rate on those goods has increased. Does the importer pay the 10% fee or the higher fee?

GB: In most cases where the tariff increases like that, there has been an “on the water” exclusion. What makes this a bit tricky, however, is that the on the water is determined by the date that the steamship line has manifested as the departure date, so this may or may not match with the tracking. We are also trying to determine how feeder vessels may fit into the equation. Often, there is a feeder vessel that off-loads to the mother vessel, and the mother vessel is the one that arrives in the U.S.

Q: How can a logistics broker/importing expert help?

GB: Understanding which tariffs are owed and how much tariffs will be can be very confusing. There aren’t a lot of simplified fact sheets on the government websites, so it’s difficult for someone that doesn’t do this every day to even know where to find the information, let alone decipher it. Logistics brokers can help determine HTS codes, duty rates that would apply, advise on paperwork and documentation needed, and interface with customs officers. We streamline and simplify the process for importers.