News July 17, 2024

Exclusive: How Much Trump & Biden Are Spending on Promo

Trump has significantly reduced his merch spending compared to previous elections, while Biden has made swag more of a focal point.

[Shortly after the publication of this article, President Joe Biden withdrew his reelection bid. ASI Media will continue to report on the spending and use of merch by the presidential candidates throughout the election cycle.]

The 2024 presidential election has taken shocking turns this summer, from the calls within the Democratic Party to replace President Joe Biden to the assassination attempt on former President Donald Trump at a rally this past weekend that claimed the life of an attendee reportedly protecting his family.

Still, the election rolled on this week with the Republican National Convention in Milwaukee, WI, where Trump was officially named the GOP’s nominee and 39-year-old Ohio Senator J. D. Vance was revealed as his vice-presidential running mate.

With polls showing the race between the candidates still very close, there’s another metric that’s also surprisingly tight: how much Trump and Biden have spent on print and promotional products.

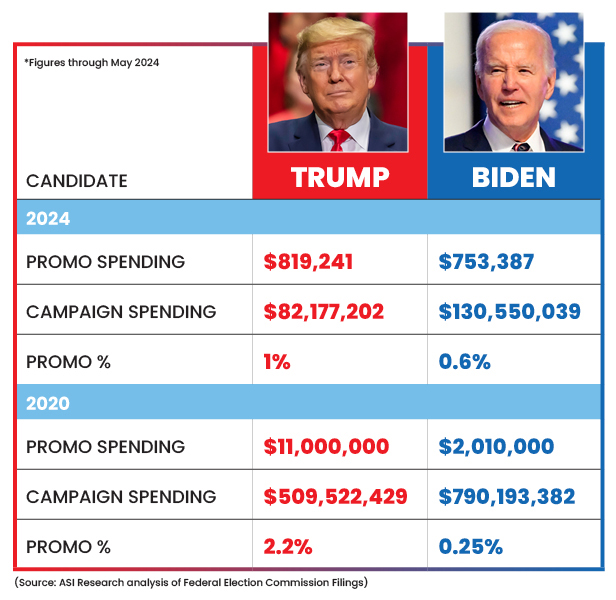

An ASI Research analysis of public campaign expenditure documents shows that through May, (the most recent month the Federal Election Commission [FEC] has made available), President Biden’s official re-election campaign has spent $753,387 on print and promo, while former President Trump’s campaign has spent $819,241.

Trump announced his candidacy for this election in November 2022 and began filing campaign finance reports in April last year. Biden, meanwhile, didn’t start submitting reports until September 2023. Over the same nine-month period from September to May, Biden actually outspent Trump by $310,891 on print and promo. Nearly 80% of the current president’s promo spending has occurred in 2024 as the general election heated up.

It’s a major shift from the previous two presidential elections in which Trump dramatically outspent his rivals on “collateral.” “Collateral” is the term used by political campaigns for print and promo.

In 2020, according to previous reporting by ASI, Trump spent $11 million on promo – more than five times what Biden spent (just over $2 million). Four years prior, Trump spent about $11.5 million through August of 2016, compared to $2.4 million by Hillary Clinton.

In fact, only 1% of Trump’s total campaign spending this election has gone to print and promo, in comparison to 2.2% in 2020. Meanwhile, compared to his total campaign spending, Biden has upped the percentage of his print and promo spend from .25% in 2020 to .6% this year.

These figures reflect the official campaign disbursements of each presidential candidate – “Biden for President” and “Donald J. Trump for President, INC.” It doesn’t include spending by political action committees (PACs). Biden’s spending covers the period from September 2023 to the end of May 2024, whereas Trump’s spending spans from April 2023 to the end of May 2024

Of course, those figures were submitted before the rally in Bethel Park, PA, and the shooting that injured the former president and led to the death of Pennsylvania resident Corey Comperatore, a Buffalo Township firefighter who was attending the rally. And it remains to be seen the effect the event will have on the election as well as campaign spending and marketing.

The Guardian and NBC were among the news outlets reporting that the Biden campaign and its supporters are pulling back on campaign advertisements to, as Biden said in an Oval Office speech on Sunday, “lower the temperature in our politics.”

Meanwhile, Trump has never been afraid to memorialize the biggest moments of his political career through merch, and on Monday Trump’s official campaign store started selling a black shirt and mug with the slogan “Fear Not” and an image that echoes the moment when Trump turned around to the cameras after being shot and raised his fist in the air. A Trump-owned company, CIC Ventures, was selling a limited run of high-top sneakers printed with the image of Trump from the rally and the words “FIGHT FIGHT FIGHT;” while an initial run of white sneakers was available for a few days, a new version in black is now being sold.

Trump is now selling $299 Assassination Attempt Edition Sneakers. There will only be 5,000 sneakers available. pic.twitter.com/MMjrUt5W9m

— SAY CHEESE! 👄🧀 (@SaycheeseDGTL) July 17, 2024

Spending Shifts

What is causing this shift in the candidates’ promo spending? It’s hard to exactly say, but there could be a few factors at play.

While Trump’s “MAGA” hats were a breakout hit in 2016, and “Keep America Great” became Trump’s slogan for the 2020 campaign, slogans from this year’s campaign (such as “Not Guilty” and “Never Surrender”) have failed to reach the same mass recognition across the country. And with “Make America Great Again” products still headlining Trump’s merch offerings in this year’s election, it’s likely that supporters are buying less because they already own these signature products.

In addition, promotional products were a key reason Trump was able to build support and broaden his visibility recognition in the 2016 election. With his base firmly entrenched, the former president and his campaign have possibly decided to not invest as heavily in promo.

It’s also been reported that Trump has paid over $100 million in legal fees with donations he has received. With the former president “spending money almost as quickly as he was raising it,” according to a Politico analysis of both candidates’ fundraising mechanisms, he perhaps doesn’t have the same financial flexibility to spend as lavishly as he previously did on promo.

Biden’s extra spending on promo could be indicative of a heightened focus on marketing. With Trump’s campaign war chest more tied up, Biden pressed his financial advantage by spending $14 million on ads in May. Since March 6, $72 million has been spent on political ads by both presidential candidates and affiliated groups that support them, with Democrats spending $49.2 million and Republicans spending $22.1 million.

Both candidates continue to spend on advertising on traditional and social media platforms, as overall political ad spending is poised to triple from 2016, surging past $12 billion on linear media channels in 2024, according to EMarketer.

One additional wrinkle: reporting from ASI Media details how unofficial merch vendors have a “symbiotic relationship” with Trump’s campaign, specifically at rallies and events. A salesperson from Tulsa, OK-based 365 Campaign told ASI Media that neither entity pays each other directly, so they don’t have to report their expenditures to the FEC. Still, the merchandising businesses donate about 10% of the revenue they make at the rallies to the campaign in exchange for vending permits, which could mean that a sizable portion of merch purchased from promo companies is difficult to track.

Main Vendors & Merch Opportunities

In its annual State of the Industry survey, ASI Research tracks the percentage of annual promo industry sales that come from elections, and reports that roughly an additional $100 million is injected into the promo market every four years when a presidential election occurs.

That translates into big business opportunities, especially for those promo vendors producing wares for the presidential candidates.

Out of merch spending that is trackable, FEC data shows that Biden purchased print and promo from 43 different companies, with most expenditures allocated somewhat evenly between Minuteman Press, Bumperactive (asi/150095) and PDQ Gills Printing (asi/292244).

Unlike Biden, the bulk of Trump’s promo disbursements this year are shared between two distributors: Drummond Press (asi/304121) and Ace Specialties (asi/103553).

View this post on Instagram

Pictured: In April of this year, Christl Mahfouz, president and owner of Ace Specialties (asi/103553) and self-proclaimed ‘MAGA Hat Lady,’ poses with Trump merch designed by her company.

Ace Specialties (asi/103553), supplier of the famous MAGA hat, has remained one of Trump’s official and most prominent promo partners throughout his three presidential races.

Financial reports reveal that the company’s impact on the GOP and nominee’s campaign is quite pervasive. Between both candidates, the distributor is a top-50 vendor for this year’s election, closely trailing companies like Meta and Target. Further, the company is a top shared vendor between the campaign and super PACs endorsing Trump, even though these two entities are not technically allowed to coordinate spending. (Biden has shared vendors such as American Airlines and Uber with his PACs, but there’s no major overlap in spending with promo or print companies.) Many former GOP candidates like Vivek Ramaswamy, Ron DeSantis and Perry Johnson have also been identified as customers of Ace Specialties.

This year, Trump has no recorded payments to California-based distributor CaliFame, a primary vendor he partnered with in 2016 and 2020. Similarly, Biden only worked on a small $400 merch order with RI-based distributor Financial Innovations (asi/194037), though it was one of his most frequent promo solutions in the 2020 elections.