News August 17, 2018

Economy Watch: Consumer Sentiment Drops to 11-Month Low

Inflation pressures appear to have driven the decrease.

In a Nutshell:

- The University of Michigan’s Index of Consumer Sentiment had a reading of 95.3 in August, down nearly 3% from July.

- Separate data on retail sales and manufacturing production was mixed.

The perception that prices are rising in the U.S. contributed to decreasing consumer sentiment to its lowest level in nearly a year through the first few weeks of August. That’s a key takeaway from the University of Michigan’s closely watched Surveys of Consumers, which came out Friday.

Basically, a sum-up of what happened to consumer sentiment in the early part of August.

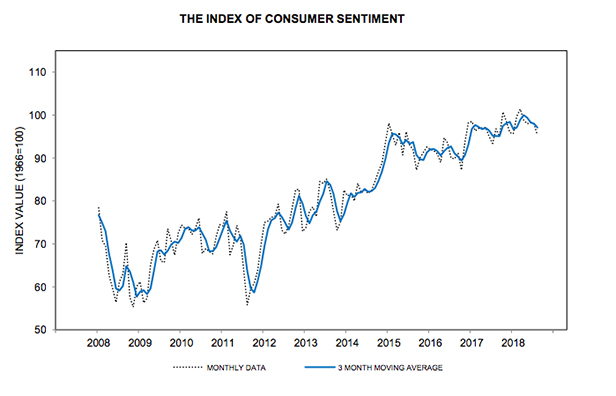

With a reading of 95.3, the Index of Consumer Sentiment was down 2.7% from July, 1.5% from August last year, and at the lowest level since September 2017 (95.1). Economists had forecast a reading of around 98. Meanwhile, the Surveys’ related Current Economic Conditions Index tallied 107.8, down 5.8% from July and 2.8% from a year ago. The Index of Consumer Expectations held steady from July (87.3) – perhaps a result of continued strong national employment numbers – but was down a half-percent from a year ago.

From University of Michigan’s Surveys of Consumers. While sentiment was down, it still remains far elevated from the dark days of the Great Recession.

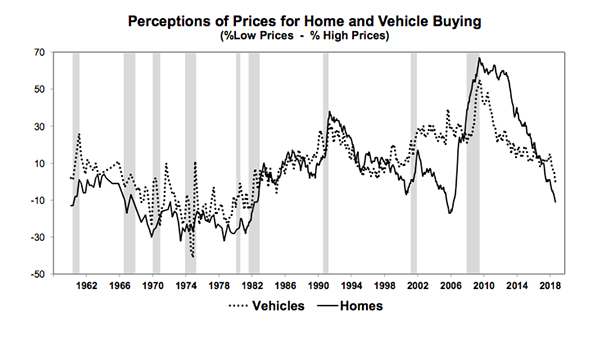

The decline in sentiment appears to be a result of consumers’ unfavorable reaction to rising prices, particularly for homes, vehicles and durable household goods. According to the data, consumers voiced the least favorable views on pricing for household durables since October 2008. Similarly, vehicle-buying conditions were viewed less favorably in August than any time in the last four years, with vehicle prices being judged less favorably than any period since the close of 1984. It wasn’t much better regarding home buying conditions, which consumers felt were less favorable than any point in the past ten years.

“The data suggest that consumers have become much more sensitive to even relatively low inflation rates than in past decades,” said Richard Curtin, chief economist for the Surveys of Consumers. “As is usual at this stage in the business cycle, some price resistance has been neutralized by rising wages, although the falloff in favorable price perceptions has been much larger than ever before recorded. Overall, the data indicate that consumers have little tolerance for overshooting inflation targets.”

The news on August consumer sentiment comes shortly after an Aug. 15 report from the Commerce Department that indicated that national retail sales rose more than anticipated in July, with households increasing purchases of motor vehicles and clothing. The Commerce Department said retail sales increased 0.5% -- better than the 0.1% economists had forecast. Amazon’s “Prime Day” promotion likely helped bolster sales.

Amazon Prime Day may have boosted U.S. retail sales https://t.co/bl2YJsU1G5 via @business pic.twitter.com/izZxACJMtg

— Yahoo Finance (@YahooFinance) August 15, 2018

Elsewhere, manufacturing activity in the U.S. again expanded in July, according to data from the Institute for Supply Management. However, the growth was slower than in June. ISM indexes gauging production and new orders in July were down from June, too.

As for consumer sentiment, Curtin and his team for the Surveys of Consumers plan to release final numbers for this month on August 31.