News February 15, 2022

Wholesale, Consumer Prices Surge Again in January

The continued rise in inflation is placing more pressure on households and businesses, including those in the promo products industry.

Inflation has soared again, with wholesale and consumer prices shooting up sharply in January, thereby heaping more cost pressures on households and businesses in the promo products industry and beyond.

The U.S. Bureau of Labor Statistics said on Tuesday, Feb. 15, that its Producer Price Index (PPI), a gauge of wholesale prices received by producers of goods, services and construction, rose 1% month over month and 9.7% year over year. The monthly spike doubled what Dow Jones economists expected, while the yearly acceleration was just below the record for most severe annual PPI inflation.

Core PPI, which excludes prices on food, energy and trade services, increased steeply too, posting a month-over-month rise of 0.9% – more than double what economists expected. The annual inflation surge for core PPI was 6.9% – only 0.1 percentage point shy of the record.

Notably, the price of goods rose faster than services in January. Final demand goods prices jumped 1.3% month over month, while final demand services prices were up 0.7%, according to the Labor Bureau.

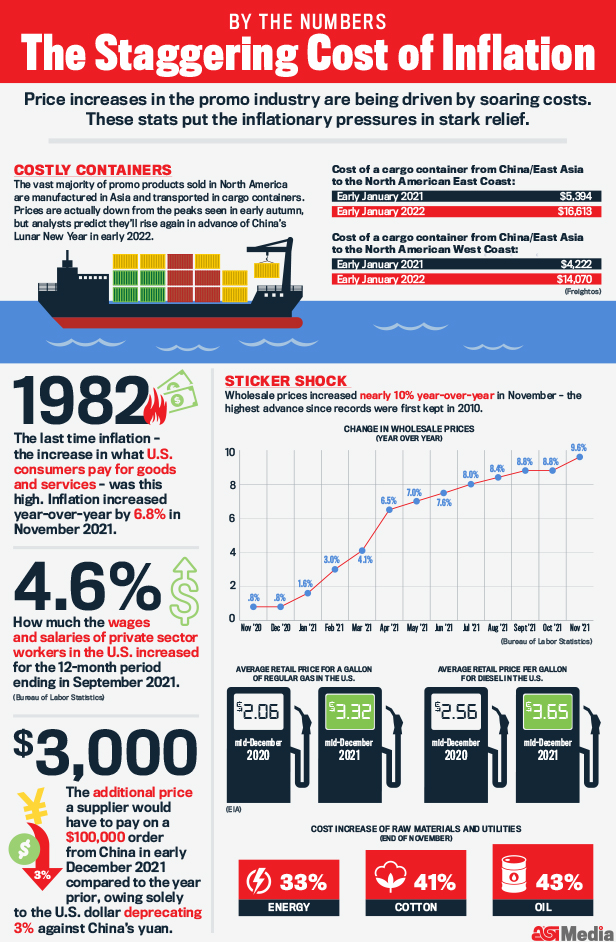

This infographic highlights some of the recent inflationary pressures that companies in the promo products industry and beyond are facing. Click here for a PDF of the graphic.

Last week, the Labor Department reported that its Consumer Price Index for January skyrocketed 7.5% compared with a year ago. On a monthly basis, consumer prices were up 0.6%. The annual inflation increase for consumer prices was the highest in 40 years.

Rising product prices are an ongoing issue with which promotional products companies have been dealing. Suppliers hiked pricing on a spectrum of items they sold in 2021 and are doing so again in 2022, often in a range of 2% to 10%, to account for inflationary pressures.

Suppliers say the price adjustments are necessary to keep their businesses viable as they shoulder the burden of heavier expenses for things like labor, raw materials, cargo containers, transportation of goods, production, utilities and more. There are other complicating factors too, such as the diminishing value of the U.S. dollar against China’s yuan.

To help tame inflation, many analysts expect the Federal Reserve to hike interest rates at a policy meeting in March.