News January 24, 2023

ASI Fort Worth 2023: Flash Polls Indicate Distributor Sales Increase, Optimism

Other quick polls of distributors conducted during a session on Education Day offered insights on the biggest challenges firms have faced and trends that resonated most with end-buyers.

An overwhelming majority of promotional products distributors say they increased sales in 2022 compared to 2021, and many are expecting another strong showing in 2023.

Such were a couple of key takeaways from real-time text-in flash polls ASI conducted with distributors who attended a standing-room-only Education Day wrap-up session at ASI Fort Worth on Monday, Jan. 23.

The event featured quick-hit recaps from expert speakers who led business-building professional development classes at the show. The five-minute-long sum-ups enabled attendees to pull an essential takeaway or two from every session on offer throughout the day.

Topics were wide-ranging. They included increasing profitability with creative packaging, enhancing communication and connections to build a stronger family business, sustainability, using ASI data and journalism to increase your sales, leveraging social media tools like LinkedIn business pages and Instagram reels to build rapport and revenue, and tactics for earning more sales from local buyers.

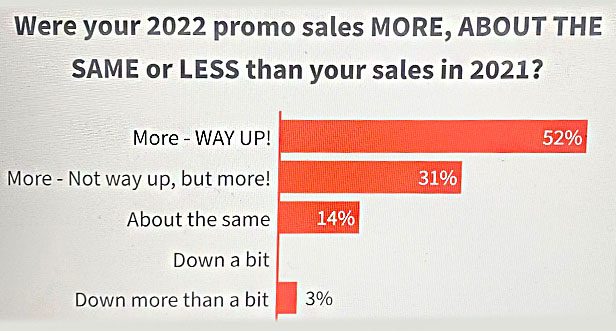

Amid the recaps, ASI conducted real-time polls in the room. In one, 52% of distributors said their sales in 2022 were “way up” compared to 2021, while another 31% said last year’s annual revenue relative to the year before was “not way up but more.” Another 14% said sales were about the same, with only 3% reporting a decline. Put another way, 97% of distributors polled in the room reported an annual sales increase or steady sales for 2022.

The flash poll showed that more than eight in 10 of surveyed distributors increased annual sales in 2022.

The positive results of the flash poll are in line with ASI Research. Industry-wide, distributors collectively generated year-over-year quarterly sales increases of 5.4% in Q1 2022, 13.5% in Q2, and 12.4% in Q3, according to the Distributor Quarterly Sales Survey from ASI Research. Final numbers for Q4 and the full year are forthcoming.

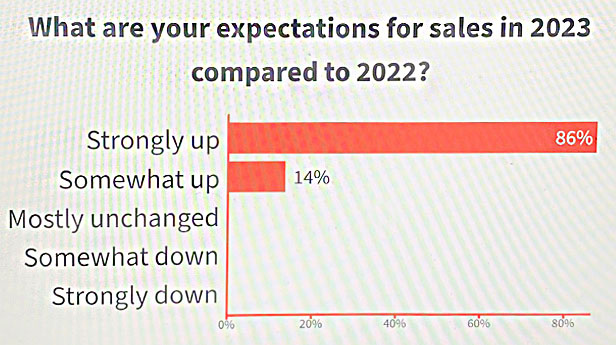

While recessionary headwinds may be blowing, distributors at the ASI Fort Worth session weren’t worried about the breeze. Another flash poll at the session asked distributors what their sales expectations for 2023 are compared to 2022. No less than 86% said they expect annual revenue this year to be “strongly up,” while another 14% predicted sales would be “somewhat up.”

The poll suggests widespread distributor optimism heading into 2023.

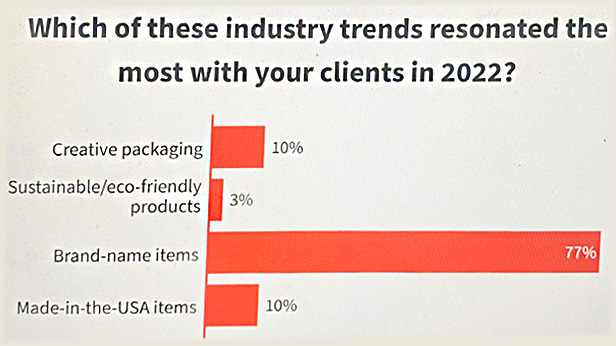

These days, it seems hardly a week goes by without a promo products supplier announcing a partnership with a retail brand. Recent examples include Top 40 supplier Gemline (asi/56070) partnering with New Balance.

Perhaps it’s not a surprise then that when asked which of four top industry trends resonated most with clients in 2022, nearly eight in 10 distributors (77%) said brand-name items. That was followed by creative packaging (10%), Made-in-the-USA items (10%) and sustainable/eco-friendly products (3%).

The flash poll indicated demand for retail brands is strong among end-buyers.

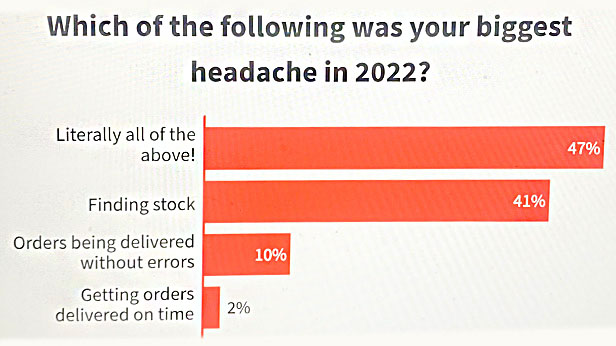

During the COVID-19 era, distributors have faced no shortage of challenges. Finding stock, getting orders delivered without errors and getting orders delivered on time were all among them. In another flash poll, nearly half of distributors surveyed (47%) said that all of those issues were their “biggest headache” in 2022. On the bright side, suppliers indicate the inventory and service picture is looking brighter in 2023.

Challenges have abounded in the COVID era, as this poll shows. Still, there’s positive word from suppliers on service levels and inventory at the outset of 2023.