News August 04, 2020

Public Promo Firms’ Q2 Earnings Results Vary Greatly

HanesBrands and BAMKO beat the odds and had strong quarters; Cimpress and Gildan struggled, posting significant sales declines.

Gildan (asi/56842) laid off 6,000 production workers during the second quarter of 2020 as the coronavirus pandemic played a lead role in driving down the Montreal-based Top 40 supplier’s revenue 71% year over year in Q2 to $229.7 million.

That was among the starker revelations to emerge from earnings reports released the week of July 26 from publicly traded companies within the promotional products industry, including Top 40 distributor Cimpress (asi/162149), leading apparel mill HanesBrands (asi/59528) and Top 40 distributor BAMKO (asi/131431).

Still, there were bright spots in the earnings data, which was generated during a quarter in which the United States’ gross domestic product declined 32.9% (on an annualized basis) as a result of societal lockdown measures and related economic fallout tied to the COVID-19 outbreak. The decline in U.S. GDP, which measures the total output of goods and services, was the worst drop on records dating to 1947.

Gildan: A Net Loss of $249.7 Million

As for Gildan, whose full earnings breakdown can be found here, net loss in the second quarter was $249.7 million. For the first two quarters of 2020, net loss stands at $349 million on sales that are down 52% over the year’s first six months to $688.8 million. Gildan reported that it kept the majority of its production facilities idle or operating at low capacity levels during Q2. The firm shuttered a specialty yarn-knitting operation in the U.S.

GDP shrank at an annual rate of 32.9% in the second quarter — the sharpest economic contraction in modern American history.

— NPR (@NPR) July 30, 2020

The economic shock in April, May and June was more than 3 times as sharp as the previous record — 10% in 1958.https://t.co/tfxF2oNQtF

Gildan pointed to several positives.

“We were encouraged by certain signs of recovery, particularly as point of sales [POS] trends during the quarter performed better than we expected across all channels,” the company reported. “By the end of the second quarter, essentially all imprintables distributor customer warehouses and the majority of retailer brick and mortar store locations had reopened in the U.S., although many with reduced operating hours. POS related to certain categories in the US imprintables channel, including fleece and fashion basics, started to turn positive in the month of June.”

Hanes: Net Income Up, Strong PPE Sales

By comparison, Winstom-Salem, NC-based HanesBrands fared considerably better during Q2.

The supplier/apparel manufacturer reported that sales dropped 1.3% compared to the same quarter the prior year, registering in at $1.74 billion. However, the decline primarily was a result of no longer running certain programs that brought in $119 million during the quarter last year. Excluding the program exits and different foreign currency exchange rates, HanesBrands’ sales were up 7%

Furthermore, even with the sales dip, HanesBrands’ net income increased year over year to almost $161.2 million in Q2. The earnings growth resulted from the company’s ability to pivot to production and sales of personal protective garments (face masks and medical gowns) combined with relatively strong apparel performance in pandemic conditions, including 68% sales growth in its online channel. Globally, the company sold $752 million in protective garments, including producing 450 million masks for the U.S. government.

“The HanesBrands organization did a phenomenal job overcoming significant challenges in order to mitigate the effects of the global pandemic,” said Hanes CEO Gerald W. Evans Jr. “The professionalism, ingenuity and dedication of our worldwide employees was on display in generating double-digit EPS growth, establishing a new protective garments business line from scratch, and starting the reopening of manufacturing, distribution and selling in the most safe and effective manner possible.”

Cimpress: Vistaprint & National Pen Struggle

Dundalk, IE-headquartered Cimpress, parent company of online branded product/print seller Vistaprint and former Top 40 distributor National Pen, reported that its fiscal fourth-quarter sales (the company’s fourth quarter runs during the calendar year’s second quarter) were $429.1 million, a 36% decline compared to the same time frame in fiscal 2019. Net loss for the quarter was $42 million, compared to a $34.1 million net income gain the prior year.

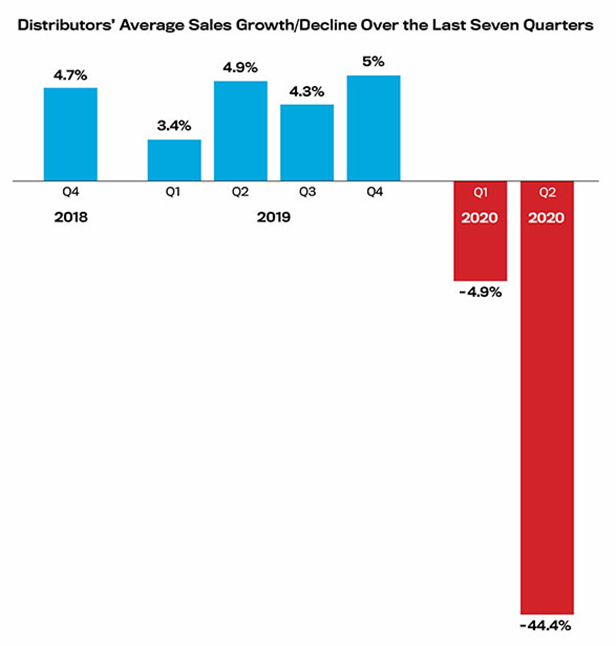

Promo distributors’ collective sales increases or declines in recent quarters. (ASI research)

For the entirety of its fiscal 2020 year, Cimpress’ sales tallied $2.48 billion, a retreat from 2019’s $2.75 billion. Cimpress managed positive net income of nearly $83.4 million for its fiscal 2020, but that was down by slightly less than $12 million compared to the previous year.

Both Vistaprint and National Pen recorded sales declines for the Cimpress fourth quarter and full year. National Pen’s annual sales dropped 14% to $299.5 million. Vistaprint’s were about $1.34 billion, a decline of about 11%.

In a letter, Cimpress CEO Robert Keane pointed to signs that business conditions are improving and also lauded employees for adapting to challenging business conditions – moves that included a pivot to selling PPE.

“While we are not yet back to the pre-pandemic level of revenue, we are steadily recovering,” Keane said. “In June our consolidated bookings were down 19% compared to the same month last year, which was an improvement from the 51% decline in the month of April. The improved bookings trend has continued through July; we expect July’s consolidated bookings to be down roughly 5% in comparison to July 2019.”

BAMKO: A 217.8% Sales Increase

Los Angeles-based BAMKO bucked the downward sales trend of the second quarter. As Counselor reported earlier this week, BAMKO increased sales – which include PPE business and traditional promo items – 217.8% to nearly $75.5 million. Sales of PPE propelled the gain, tallying $49.7 million. BAMKO’s sales (North American and international) of traditional promotional products rose about $2 million year on year to nearly $25.8 million in Q2 2020.

“In responding to the needs of our customers, the sourcing team within the promotional products segment began sourcing much-needed personal protective equipment for our customers,” executives from Superior Group of Companies, BAMKO’s parent firm, wrote in an earnings report. “These opportunities led to record revenue levels during the second quarter of 2020, despite the downturn [that] the branded merchandise industry has experienced [because of] customer budget cuts and widespread event cancellations.”

According to ASI’s recently released Distributor Quarterly Sales Survey, only 8% of North American promotional products distributors increased sales in the second quarter of 2020. On average, distributors’ sales collectively declined 44.4% compared to the same quarter the prior year. The decline was a direct result of the economic disruption caused by COVID-19.