News June 18, 2020

Study: Gen Z, Millennials Flock to E-Commerce

The research showing how COVID has influenced shopping and media habits could predict consumption behavior post-pandemic.

A new study from research firm Boston Consulting Group and multimedia messaging app Snapchat predicts, in part, how Gen Z and millennials’ shopping and media consumption habits could be changed as a result of the coronavirus pandemic – findings that marketers in the promotional products industry and beyond who want to reach such audiences might want to consider.

The study, which you can find in full detail here, based its findings on responses from 9,500 people in the Gen Z and millennial generational cohorts in the U.S., U.K., France and Canada.

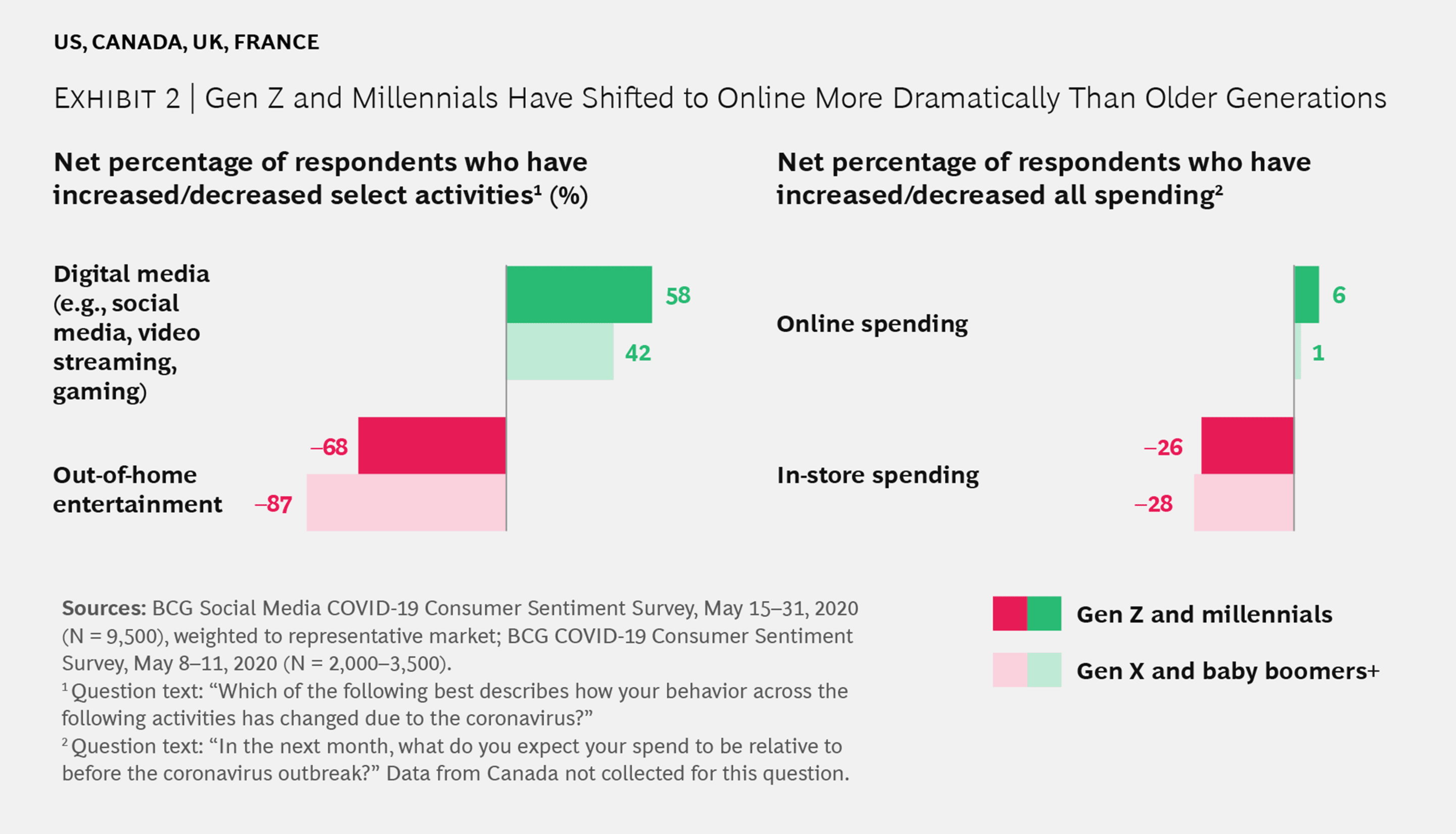

While all generations are spending more in online shopping as a result of societal lockdown measures tied to COVID-19, it’s Gen Z and Millennials who are spearheading the migration to e-commerce, the study found. Since the pandemic began, 33% of Gen Z/millennial consumers have increased their online spending, for a net increase of 6%, versus 23% of consumers in older generations, or a net increase of 1%.

“This acceleration of e-commerce is occurring on two fronts: a shift of existing products, services, and retailers to online, and a surge in digital-only or digital-first products, services, and retailers,” the study notes.

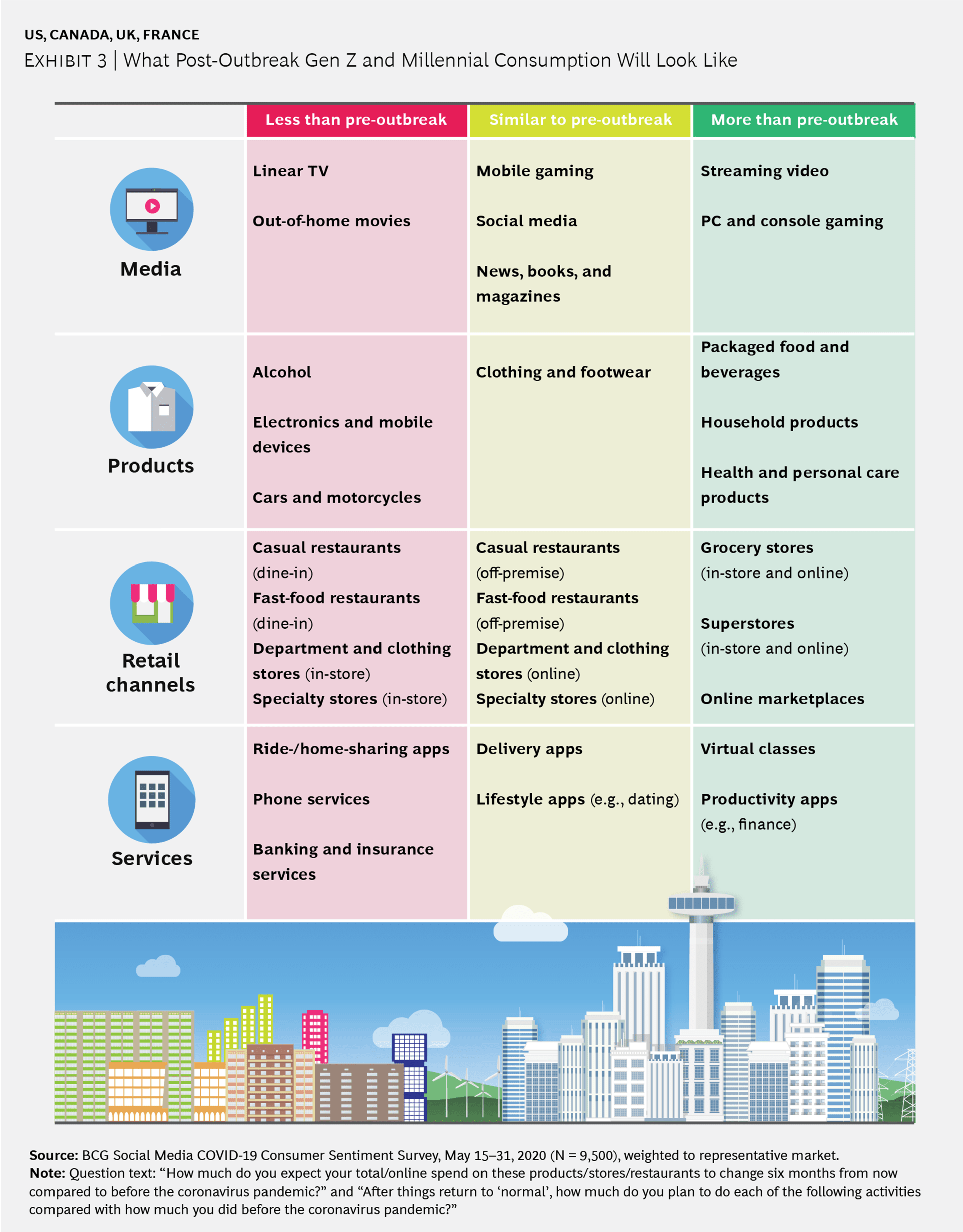

What’s more, the study predicts that COVID-influenced Gen Z and millennial digital habits on everything from shopping to media consumption will continue to an extent post-pandemic. The generations “will at least partially sustain the increase in the time they are spending on digital media,” researchers note.

According to the findings, a net 10% of millennial and Gen Z consumers anticipate that they’ll increase spending on packaged food and beverages, while 12% plan to do the same on household products. Some 6% expect to spend more on health and personal care products.

Gen Z and millennial “consumers expect to offset these increases by reducing their spending in discretionary categories such as alcohol (a net 8% decline) and by delaying purchases of high-ticket items such as electronics, mobile devices, and cars and motorcycles (with a net of approximately 20% of consumers indicating that they would delay spending on each of these categories),” researchers write in the study.

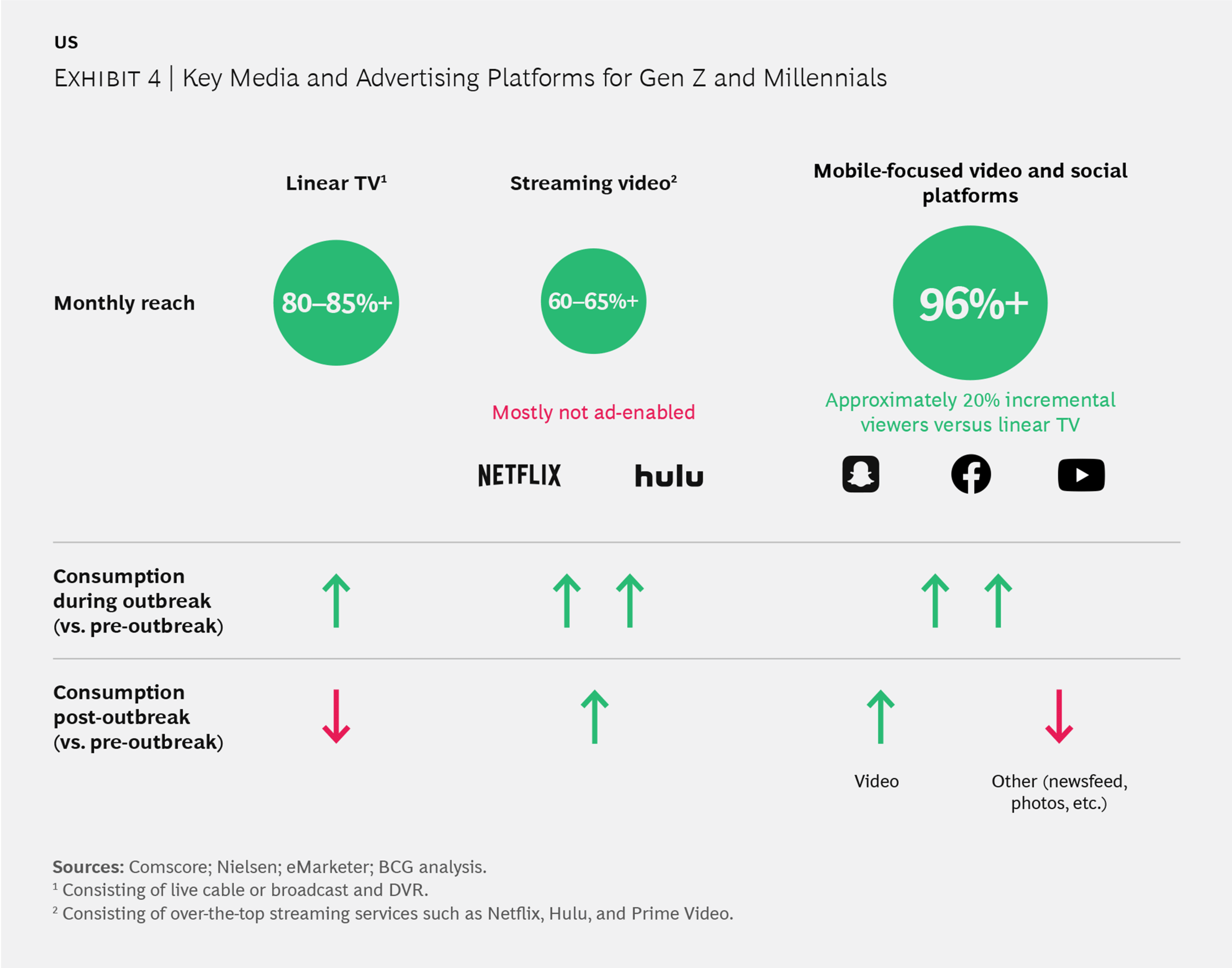

The study also looked at what media and advertising platforms might be best for reaching millennials and Gen Z during and after the pandemic. Currently, consumption is up in digital, including mobile, versus television – and that dynamic appears poised to continue, researchers note.

“Lean in on digital, including mobile, at the bottom of the funnel,” the study advises marketers. “Given the increasing use of e-commerce that younger consumers are leading, marketers should consider increasing their investment in direct-response advertising on digital and social media platforms, where the jump from advertising exposure to purchase can be immediate. Among Gen-Z and millennials, 60% say that an advertisement on social media has influenced their purchase decision during COVID-19, compared to 25% of older generations.”