News October 23, 2020

Holiday Season to Intensify Promo’s Shipping Woes

Industry firms are expecting increased delivery delays and costs but are working to mitigate impacts.

Demand stress on shipping carriers is already causing delivery delays and increased costs for promotional products companies – issues many expect to intensify as the holiday season revs into high gear.

Top 40 distributor The Vernon Company (asi/351700) reports that it’s already experiencing shipping delays from suppliers. The Newton, IA-headquartered firm says the delays haven’t been a big deal, with impacts not significant enough to affect customers. Still, executives are concerned the delays will worsen as the holidays near, potentially negatively affecting orders.

“We’ve been receiving updates from suppliers telling us to prepare to expect shipping issues,” said Vicki Palm, Vernon’s director of marketing. “We are expecting an increase in transportation issues, both in cost and delays. We’ve started to experience these issues now, and we expect them to get worse as the volume of orders and shipments increases.”

The challenges are by no means limited to Vernon.

“We have seen longer transit times from our standard carriers outside of their published transit times,” said David Nicholson, president of New Kensington, PA-based Top 40 supplier Polyconcept North America (PCNA; asi/78897). “In certain zones, ground deliveries were typically about 99% on time. Today, it feels like it’s closer to an 80% reliability level.”

David Nicholson, PCNA

Nicholson and other industry leaders anticipate that the delays and their related problems will grow in the final months of 2020.

“When you consider the normal seasonal increase in shipping volumes that is driven by the holidays and you now overlay the shifts in buying habits driven by COVID-19, it’s going to be a very challenging period for carriers,” Nicholson asserted. “Last year was difficult. This year will be really disruptive for time sensitive shipments.”

Unprecedented Demand Triggers Challenges

As Nicholson alludes to, current and forecasted shipping delays are in substantial part a consequence of the coronavirus pandemic. Due to business shutdowns and a desire to avoid public spaces consumers have been shopping online like never before.

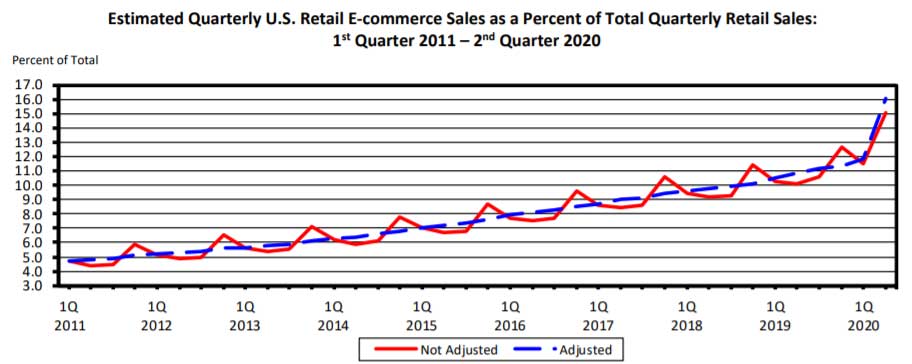

The U.S. Department of Commerce estimated that retail e-commerce sales in the second quarter of 2020 were $211.5 billion, a 31.8% increase from the first quarter and a 44.5% year-over-year spike from Q2 2019. The second quarter tally meant that $1 in every $5 spent at retail came from e-commerce, with Q2 2020 registering the highest year-over-year growth of any recorded second quarter and the second highest growth rate of any quarter or year overall going back to when the government began tracking online shopping at the end of 1999, according to reports.

Data from the U.S. Department of Commerce

A consequence of all the online shopping is that shippers are being stretched to the maximum to get ordered deliveries to their destinations. FedEx Corp. and UPS Inc. say they’ve been operating at peak holiday capacities already. What’s more, the rapid rise in e-commerce is expected to accelerate. The Deloitte annual holiday retail forecast estimates that e-commerce sales will grow by 25% to 35% year over year during the 2020-21 holiday season, compared to 14.7% growth in 2019. Relatedly, an analysis predicts that seven million more packages will be delivered per day between Thanksgiving and Christmas this year – a deluge The Today Show referred to as “Shipageddon”. Some experts predict not all packages are going to arrive on time.

“We’re anticipating an unprecedented peak season. It will be an industrywide ‘shipathon’ that we’ve never seen before,” Ryan Kelly, vice president of global e-commerce marketing at FedEx Corp, told Transport Topics.

All that translates to more strain on shippers. Despite hiring efforts and logistical maneuvering, shippers probably aren’t going to have the capacity to keep up with normal on-time delivery levels, analysts believe.

“The bottom line is that everybody is projecting significant growth, and I think it is safe to say there is much more demand in the marketplace than there is capacity,” Richard Metzler, CEO and president of Lone Star Overnight, an Austin, TX-based parcel delivery company, told Transport Topics.

Furthermore, the cost of shipping has gone up, and that could continue. UPS, for instance, was already instituting peak surcharges to “reflect current market conditions caused by the pandemic, which includes consumer demand and available capacity,” a spokesperson reported.

“There is definitely more competition now for scarce shipping resources,” said John Bruellman, president and CEO of Sign-Zone, parent company of Minnesota-based Top 40 supplier Showdown Displays (asi/87188). “There have been some attempts from the carriers at cost increases, but we have managed that pretty well. So far, we’ve seen a slight uptick in late deliveries.”

The rampant, unprecedented demand is combining with other factors to concoct a perfect storm for shipping challenges. Driver shortages are a problem, some say. Regulations that limit the amount of hours a carrier can have a driver on the road is another factor, said David Miller, president of Hicksville, NY-based Top 40 supplier Chocolate Inn/Lanco (asi/44900). Other exacerbating factors are promo-industry specific.

“The rise in demand for drop shipments within our industry is a compounding issue,” Nicholson said. “It drives up the volumes going through the package carriers; consider a 10,000-unit order that a year ago may have gone bulk via LTL but is now 10,000 individual packages going through the UPS system. Also, the drop shipment trend requires longer lead times for suppliers to complete the more complex fulfillment process.”

Plan Ahead This Holiday Season

Faced with shipping challenges, promotional products distributors and suppliers are trying to adapt to minimize disruption.

The Vernon Company, for instance, is communicating with account executives and customers, informing them about shipping issues and asking all to plan accordingly.

“We are encouraging them to order holiday gifts early and to expect an extended timeline on delivery,” said Palm. “We don’t want them to wait until the last minute and expect a rush order to make their delivery date. That most likely will not happen. We’re trying to prepare them and set their expectations for a slower delivery time.”

Nicholson said Vernon’s approach is smart. “The best option is always to plan ahead and to allow for a few extra days of transit times,” he said.

Of course, service-minded suppliers like PCNA are taking steps to smooth over shipping roadblocks. “We continue to work closely with our preferred carriers as the fourth quarter sets in,” Nicholson said. “We have set up dedicated trucks that will run to primary sorting facilities and will have priority pickup times.”

The logistics team at Showdown Displays is in daily, sometimes hourly, communication with carriers to keep shipments moving as quickly as possible. Chocolate Inn/Lanco, which Miller says is the largest UPS customer on Long Island, has had extensive communications with UPS and the carrier has “addressed our concerns and instilled further confidence.” The supplier’s plan includes shipping all orders a day earlier.

Meanwhile, Kalamazoo, MI-based Top 40 supplier Edwards Garment (asi/51752) has taken steps that include slotting frequently ordered products in locations closer to pack-and-ship stations.

“By doing this, the warehouse associate can quickly select the products and get them to shipping in order to improve service levels,” said Taraynn Lloyd, vice president of marketing.

“Our goal is that all blank orders entered by 5 p.m. eastern time are shipped the same day.”