News October 21, 2020

Promo Distributor Sales Drop 24.8% in Q3

The year-on-year decline was nonetheless an improvement from the previous quarter, and the Counselor Confidence Index took a notable upswing.

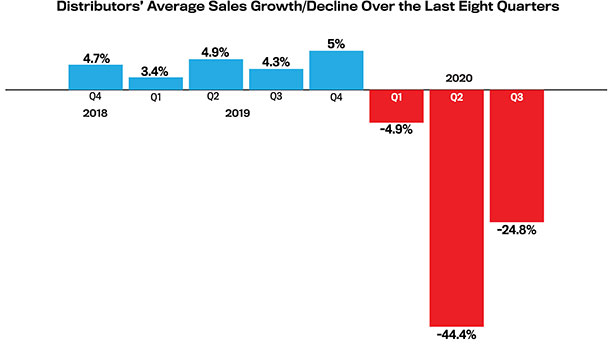

It’s getting better, but after more than a decade of continuous quarterly sales gains, North American promotional products distributors’ sales declined for a third straight quarter.

Distributor sales have now declined, on average, for three straight quarters.

Distributor sales dropped, on average, by 24.8% in the third quarter of 2020 compared to the same quarter the prior year, according to ASI’s just-released Distributor Quarterly Sales Survey. Still, that nearly 25% drop was a marked improvement over the record-breaking 44.4% year-on-year plummet in Q2 2020.

Click here for a larger image of the above graph.

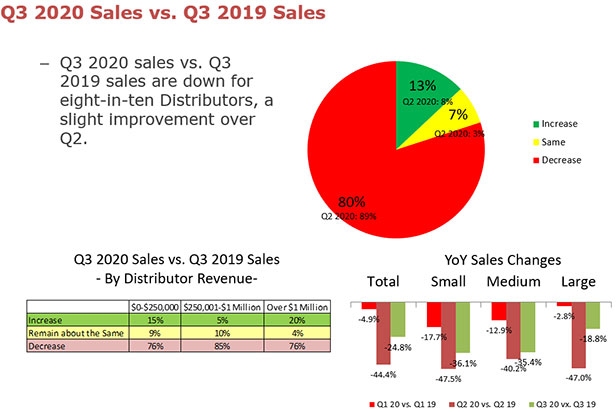

In the third quarter of 2020, sales were down for eight in 10 distributors, better than in Q2 when that number was nearly 90%. The industry’s largest distributors – those with revenue of more than $1 million – fared the best, with sales being down just under 19% in Q3 2020 compared to the same period the prior year. The industry’s smallest distributors – those with revenue of $250,000 or less – reported a collective year-on-year sales drop of 36.1%.

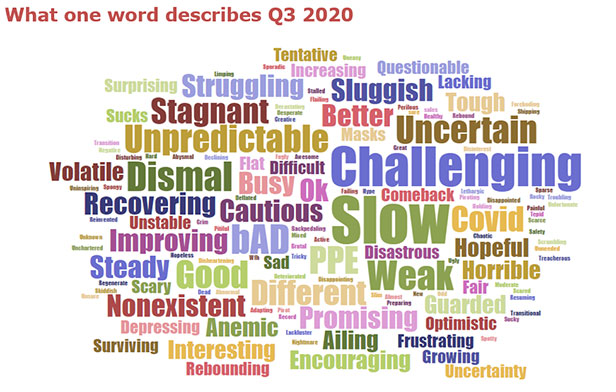

Words distributors used to describe the third quarter of 2020. Click here for a larger image of the above graph.

During the third quarter, the lifting or easing of societal and business lockdown measures tied to the ongoing COVID-19 pandemic, which were at their strictest in the second quarter, helped create marketplace conditions that were somewhat more favorable to sales of promotional products – a key factor in the overall business improvement for distributors in Q3. Demand for kitted/drop shipment solutions and the continued, if in some cases tempered, sale of personal protective equipment (PPE) also helped fuel the sales rise.

At Quincy, MA-headquartered distributor Stran Promotional Solutions (asi/337725), sales rose 8% in the third quarter of this year compared to Q2. Year over year, Q3 sales shot up 16% compared to the 2019 third-quarter revenue number. Company President Andy Shape told Counselor that a double-digit increase in transactional (drop ship) business drove the gain.

Andy Shape, Stran Promotional Solutions

“We accomplished this by having our sales and marketing teams target and identify customers in the consumer and retail space who had immediate needs that we could fulfill immediately through creative product suggestions and effective supply chain management,” Shape said.

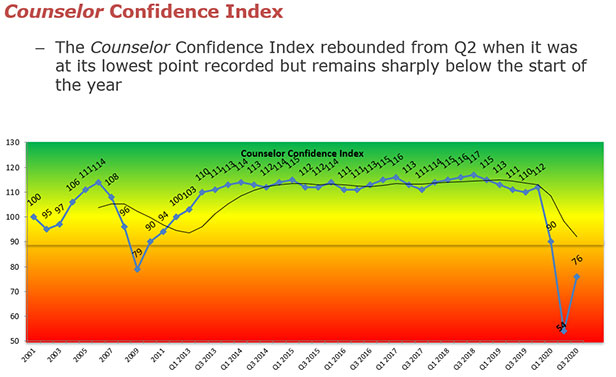

Buoyed by the better business atmosphere, the Counselor Confidence Index, which measures distributors’ financial health and optimism, rose from a record low reading of 54 in Q2 to 76 in Q3. Still, that’s the second-lowest reading in the 19-year history of the index, with the pre-COVID low of 79 being recorded in 2009 during the economic downturn known as the Great Recession. The baseline reading is 100.

The Counselor Confidence Index improved in Q3 but remained near a historic low. Click here for a larger image of the above graph.

“Sales rebounded in Q3 compared to Q2, but are still facing significant headwinds as the industry heads into the all-important Q4 period, which is traditionally promo’s strongest quarter,” said Nathaniel Kucsma, ASI’s executive director of research and corporate marketing. “While it’s a certainty that sales will definitely be down for all of 2020, it remains to be seen how the year will finish, and more importantly, how Q1 will shape up.”

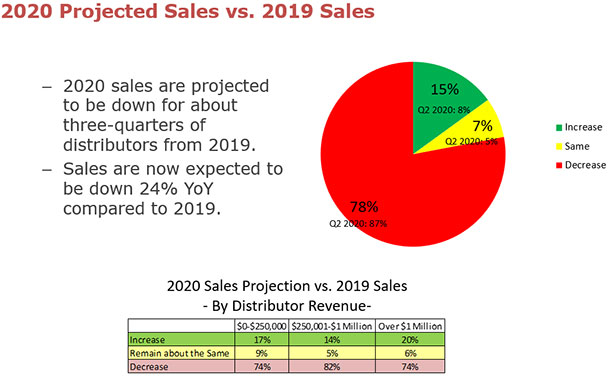

ASI’s survey showed that more than three-quarters of distributors (78%) believe their total 2020 sales will be less than in 2019. Distributors now see annual sales falling, on average, by 24% – an improvement over Q2 when promo professionals were forecasting a 35% decline.

Despite improving sales in the third quarter, distributors are still predicting a precipitous decline for the year. Click here for a larger image of the above graph.

“I anticipate my sales to be much lower than in 2019 in the fourth quarter and for the year as a whole, but I am still getting my big orders, so I have been surviving thanks to that and the help of the Paycheck Protection Program and disaster loan,” said Kelly Moore, owner of St. Petersburg, FL-based distributorship Moore Promotions (asi/601617).

Looking ahead, some are upbeat about 2021. Christopher Faris is among them.

The founder/CEO of Boost Promotions (asi/142942) noted that his Gloucester, MA-based distributorship bucked the industry trend and posted record-high sales in the first and second quarters of 2020 thanks to a successful pivot to PPE, adding more services and other savvy proactive initiatives. Q3 2020 was roughly flat with Q3 2019, as PPE sales slipped a bit from Q2 and as traditional promo business hadn’t fully bounced back, but that’s not stopping Boost from driving an annual sales increase in 2020 and thinking big for 2021.

“2021 will be another great year,” said Faris. “With all our new offerings and expansion, we are better equipped than ever to help our clients in the new economy.”