Sustainability CANADIAN NEWS August 15, 2025

Infographic: Sustainability Matters in Canadian Promo

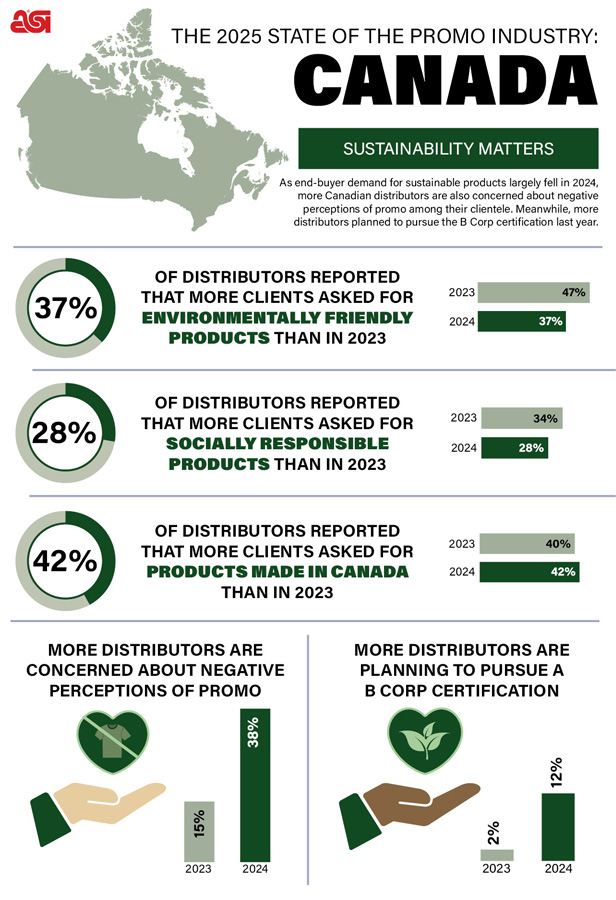

State of the Industry data from ASI Research highlights demand for environmentally friendly, socially responsible and domestically made products.

Key Takeaways

• End-buyer demand for sustainable and socially responsible products declined in 2024, though there was also a notable increase in Canadian distributors planning to pursue a B Corp certification.

• Demand for Canadian-made products is rising, with a slight increase from 40% to 42% in 2024, and expectations for further growth in 2025 due to trade tensions with the U.S. Distributors are also grappling with growing concerns about negative perceptions of promo.

Though end-buyer demand for sustainable products dropped slightly in 2024, Canadian distributors still largely prioritize their eco-bona fides.

ASI Research found that in 2024, the percentage of distributors reporting an increase in requests for environmentally friendly products fell to 37% from 47% the year before. It was a similar story when it came to socially responsible items – those reporting more demand among end-buyers ticked down from 34% in 2023 to 28% in 2024.

Brian Leigh, vice president of sales and marketing at Promotional Source (asi/301292) based in Oakville, ON, posits that economic uncertainty and buyer caution are contributing to the drop in demand for eco-friendly and socially responsible merch. “Clients may want a sustainable option, but budgets are dictating a compromise,” he says.

Still, ASI Research found that the number of Canadian distributors planning to pursue the B Corp certification increased from 2% in 2023 to 12% in 2024, indicating that at an operational level, commitment to sustainability is rising in importance.

Meanwhile, demand for Canadian-made items increased slightly from 40% in 2023 to 42% in 2024. That number is sure to surge in 2025 due to ongoing trade wrangling with the U.S.

“End-buyers and -users are deliberately avoiding U.S.-made or -supplied products because of the headaches, uncertainty and instability,” says Leigh. “I’m seeing long-term options and investments among suppliers to better keep up with this growing demand in the future.”

At the same time, distributors remain concerned about end-buyers’ negative perceptions of promo products, with nearly 40% saying it’s a challenge (up from just 15%) in 2023. Leigh says objections can largely be countered with more education and in-depth conversations.

“Branded merchandise has come a very long way, and it has so many wonderful attributes when it comes to the number of impressions, value for the money invested and emotional connection,” says Leigh. “We as an industry need to do a much better job communicating those things. Let’s stop selling widgets and talk about advancements in product attributes and giveback programs that support communities, the environment and individual well-being.”

Click here for a PDF of the below infographic.

Promo for the Planet is your destination for the latest news, biggest trends and best ideas to help build a more sustainable and socially-responsible industry.