Research September 05, 2025

Infographic: The Sales Environment in Canadian Promo

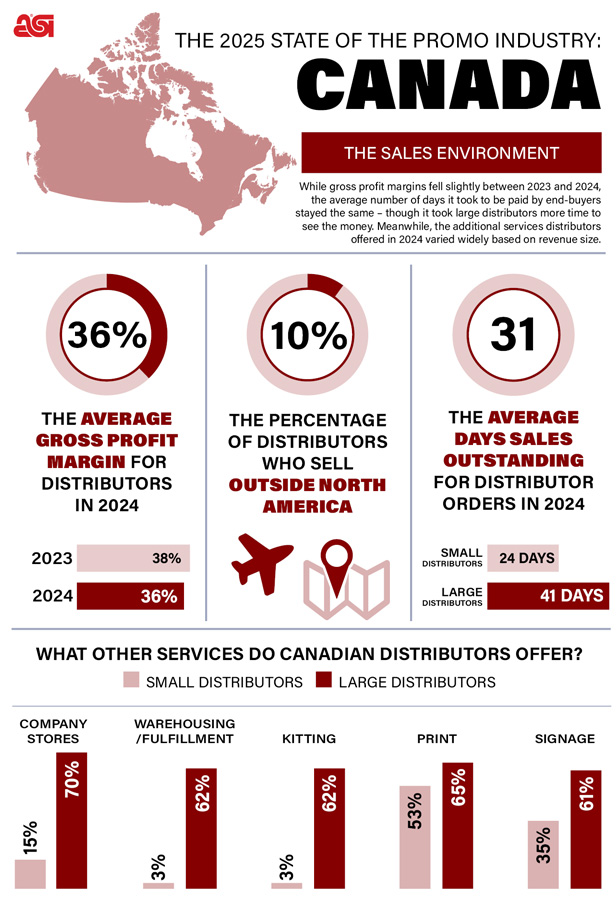

While gross profit margin fell slightly between 2023 and 2024, the average number of days distributors waited to be paid by end-buyers stayed the same – though it took longer for large firms to see the money. Meanwhile, the additional services offered in 2024 varied widely based on revenue size.

Key Takeaways

• The average gross profit margin for Canadian distributors slightly declined to 36% in 2024, down from 38% in 2023, indicating a modest tightening in profitability.

• Large distributors are significantly more likely than small firms to offer additional services like company stores, warehousing/fulfillment and kitting.

Among Canadian distributors, average gross profit margin ticked down slightly in 2024, according to ASI Research.

New State of the Industry data shows that average margins hit around 36% last year – healthy, but slightly lower than 38% in 2023.

It also took about a month on average – 31 days – for distributors to get paid by their customers. It was shorter for small distributors (24 days) and longer for large (41).

Danny Braunstein, the Winnipeg-based director of client success for Counselor Top 40 distributor BAMKO (asi/131431) in Canada, says average profit margins have increased year over year and the team saw a 14% sales increase in Q2, despite overall economic caution in Canada. “Traditionally, our organization has performed very well in times of economic uncertainty,” he says. “We see a lot of opportunity for additional growth in the current market.”

Differences between small and large distributors were also apparent when it came to services offered besides promo products – while 70% of large companies report offering company stores in 2024, just 15% of small said the same. It was a similar reality when it came to warehousing/fulfillment and kitting (62% of large vs. 3% small). Meanwhile, there was a smaller gap between large and small who offer print (65% vs. 53%).

Braunstein says offering services beyond promo continues to pick up steam. “Clients are looking for ways to reduce the number of vendors they work with,” he says. “We see significant growth in our commercial print division and POP/POS. We’re constantly adding more services to meet our clients’ evolving needs, and our in-house creative team and industry-leading technology stack are key differentiators.”

Click here for a PDF of the below infographic.