Product Hub CANADIAN NEWS July 11, 2025

Canadian Distributors Search for Classic Categories, Promo Stalwarts in ESP Amid Q2 Economic Uncertainty

Meanwhile, searches for “made in Canada” fell 72% between the first and second quarters.

Key Takeaways

• Classic Promo Demand Remains Consistent: Canadian distributors continue to rely on staple promo items, which ranked among the top search terms in ESP in Q2, amid trade tensions and economic caution.

• Seasonal & Event-Driven Trends Influence Searches: Search behavior varied month to month, reflecting seasonal campaigns and event planning.

• Shift in Preferences & Customization Trends: There’s a growing demand for premium and retail-inspired products, and customized apparel with unique decoration techniques like DTF and chain stitch embroidery.

Canadian distributors continue to search for promo go-tos in ESP as trade and general economic uncertainty continues.

New data from ASI Research shows that, similar to the first quarter of the year, “pens” and “water bottle” were the first and second most-searched terms in ESP in Q2. “Tote bag” took the third spot, followed by “golf balls” and “keychain.” Queries for the seasonal “beach ball” rounded out the top 10.

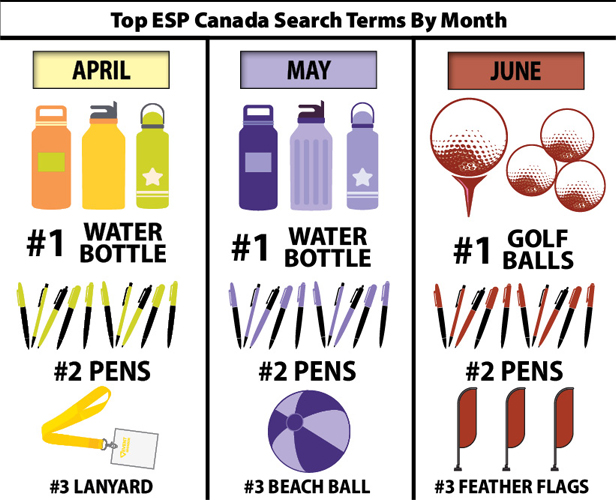

There was some variation in the top search terms by month. In April, “water bottle,” “pens” and “lanyard” dominated ahead of summer events. In the following month, “beach ball” came in third, and by June, distributors were searching mostly for “golf balls,” “pens” and “feather flags,” ideal for outdoor promotion of businesses.

“Despite the chaotic news cycle of the second quarter, Canadians seem to be moving forward with their summer campaigns,” says Hannah Rosenberger, data analytics editor, “with warm weather searches like golf balls, beach balls and water bottles topping the ESP search list for the spring months.”

Among the largest year-over-year increases were “carabiner” (up 734%), “feather flags” (up 414%) and “polo” (up 281%). Terms with the most significant year-to-year decreases include “umbrella” (down 68%), “beach towel” (down 47%) and “bucket hat” (down 46%). Meanwhile, searches for “made-in-Canada” items fell 72% between Q1 and Q2.

Searches for “made in Canada” fell 72% between Q1 and Q2 of 2025. (ASI Research)

“I’m not surprised that ‘made in Canada’ has fallen off as much as it has,” says Danny Braunstein, the Winnipeg-based director of client success for Counselor Top 40 distributor BAMKO (asi/131431) in Canada. “Canadians have taken the U.S. tariffs very personally, which has spawned a big push for buying Canadian and opening up provincial trade lanes. However, when it comes to branded merch, the variety, customization options, technology, capacity and price points from the global supply chain are very difficult to compete with.”

Overall, the top-searched products in ESP in Q2 are aligned with client demand that Braunstein and his team have been seeing. Tote bags, particularly premium canvas boat bags, have been in high demand among BAMKO’s clients, as well as insulated tumblers and bottles from brands like Owala, Stanley and YETI, along with retail-inspired designs. In apparel, premium athleisure has been the distributor’s biggest new growth category, while premium rope caps and hats with upside-down imprints, like those from collegiate headwear company True Brvnd, have been a hit.

“Unique decoration on classic wearables has really exploded,” says Braunstein. “The continued adoption of DTF has opened up a whole new world of customization and personalization, and retro techniques like chain stitch embroidery and chenille collegiate-style emblems have made a huge comeback.”

Canadian buyers are still generally judicious with spend due to economic factors and ongoing trade wrangling with the U.S. Indeed, President Trump has threatened an additional blanket tariff of 35% on all Canadian imports – on top of what's already in place – starting Aug. 1, citing the continuing flow of fentanyl across the border. Prime Minister Mark Carney says he'll continue to negotiate on that front. Still, Braunstein says he's looking forward to renewed enthusiasm heading into the second half of the year.

“End-buyers still seem to be cautious as they watch what’s happening on the tariff front, and it has significantly impacted some of our largest industries,” he says. “Some have had to slash marketing budgets and decrease headcounts, but I expect that things will pick up in Q3 as folks realize they have budgets that they need to spend and roll into Q4, which is typically the strongest month for the industry.”

Product Hub

Find the latest in quality products, must-know trends and fresh ideas for upcoming end-buyer campaigns.